Q1 2025 Review

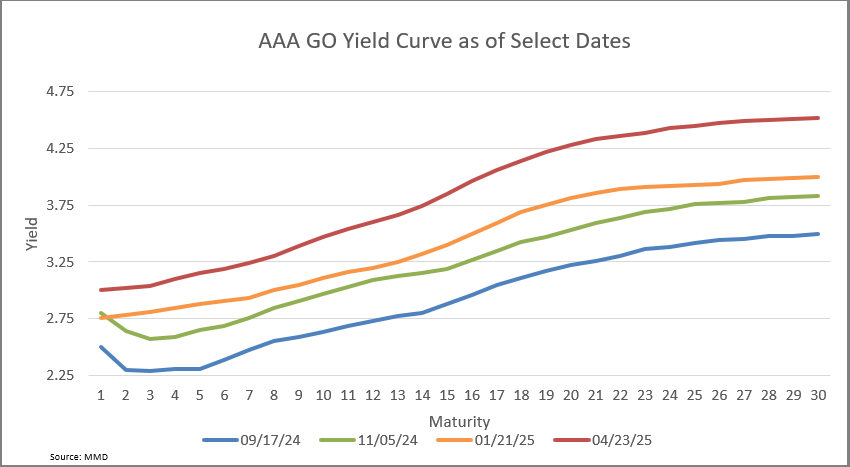

It has been an eventful beginning to Donald Trump’s second Presidency. He ran on a platform promising improved border security, expansive tariffs, re-shoring to bolster manufacturing in the US, and a clear focus on reduction of government spending and fiscal responsibility (DOGE). So far, he is trying to make good on all his promises. Markets, however, have struggled digesting the barrage of information with stocks in bear market territory and yields climbing. As seen below, Muni yields have continued to rise from the Fed’s first cut (9/17/24) to Election Day (11/5/24), to Inauguration Day (1/21/25), to this week as concerns of lingering inflation persist.

Department of Government Efficiency (DOGE)

DOGE (https://doge.gov) is one of the President’s initiatives aimed at “cutting wasteful government spending.” The program reviews all federal departments and payments with stated goals of reducing the deficit, streamlining federal operations, and cutting spending moving forward. DOGE has received both support and criticism for its actions. One clear example of the DOGE effect—seen below—is the contribution of Total Government Jobs added in the first 2 months of 2025. Under the previous administration, one of the largest contributors to job growth nationwide occurred in the government sector. This growth has experienced a major shift beginning in 2025 as the government contribution to total jobs added fell from 23% to 6%. This trimming may be necessary if Social Security, Medicare, Medicaid, and Defense spending remain untouched.

Consumer Sentiment Near All-Time Lows

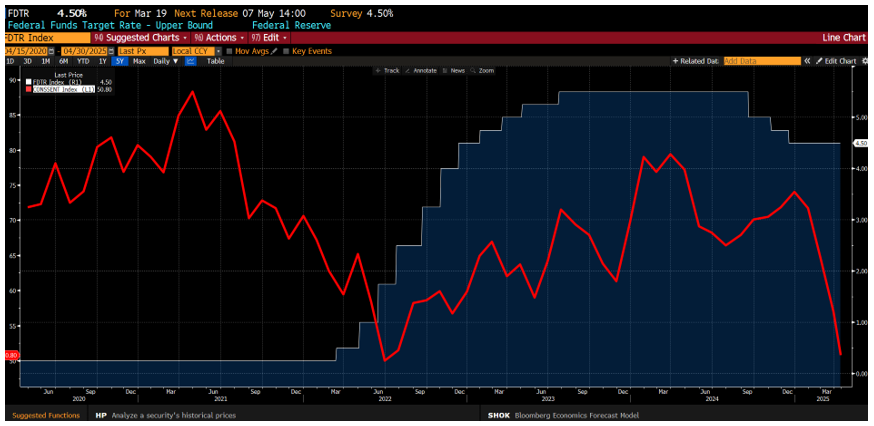

The University of Michigan Consumer Sentiment Index is nearing all-time lows with data that goes back to 1978. The low in sentiment occurred less than 3 years ago in June 2022 when the Fed was behind the curve in raising rates to fight inflation (see Sentiment chart below in red overlayed with the Fed Funds Rate). The Federal Reserve saw the all-time low in 2022 and reacted to this survey by increasing how much they raised rates at their next meeting. We do believe it is worth taking note. Sentiment began falling at the beginning of 2025 and can be attributed to a combination of the reasons below:

Global Trade Tensions: As trade-related updates rapidly flood news feeds, companies are beginning to communicate how it will hit their bottom lines in future quarters. While some countries appear willing to negotiate, others have prepared for a standoff.

Surging Inflation Expectations: While this seems extreme, consumers surveyed by the University of Michigan anticipate a 6.7% increase in prices over the next year – the highest expectation since 1981.

Labor Market Concerns: Despite a low unemployment rate, recession fears have gained traction, and the share of consumers expecting unemployment to rise hit its highest level since 2009.

Market Volatility: The decline in consumer sentiment closely tracks the downturn in equity markets beginning February 21st. The resulting wealth shock has weighed on households in the past 2 months.

Policy Uncertainty: Instability undermines confidence. The frequent and unpredictable shifts we have seen in policy have made the economic outlook more uncertain. This environment has made it more difficult for families and businesses to chart a clear path ahead, hurting overall sentiment.

Source: Bloomberg

Weakness/Recession Looming?

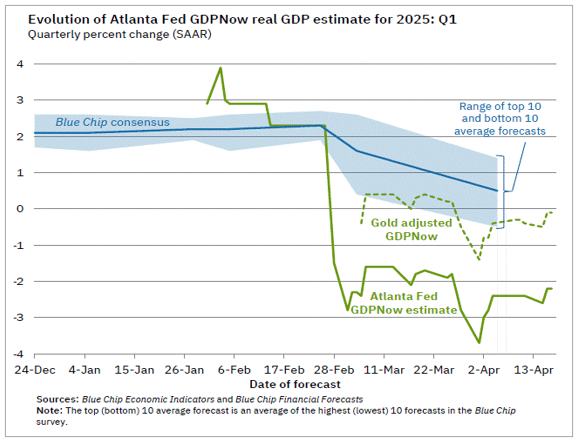

Recent updates from Atlanta Fed’s GDPNow model have shown sharp downward revisions in estimated U.S. GDP growth, reflecting weaker-than-expected economic data. This forecasting model revises estimates when relevant data is updated from the ISM and Bureau of Economic Analysis. This drop stemmed from recent reports on retail sales and international trade. Such swift adjustments highlight the model’s sensitivity to real-time data and may suggest that economic momentum is softening.

Source: Atlanta Fed

Or Just Broken Indicators?

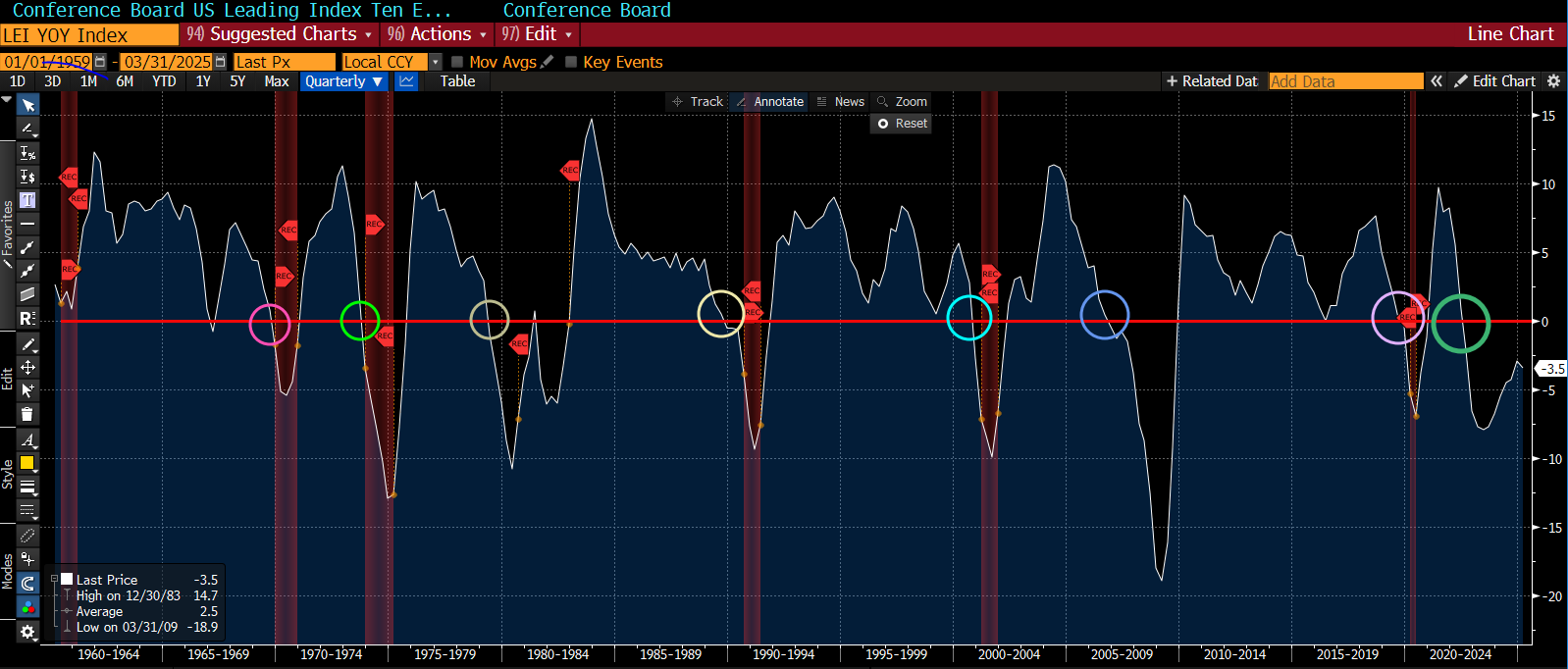

Below is a Bloomberg chart illustrating the Conference Board’s Leading Economic Indicators Index (YoY). Historically, a drop below zero has preceded each of the past eight recessions—we now sit at -3.5. Since 2022, several indicators like this have seemed out of sync with broader economic conditions. While some respected voices in the industry argue we may already be in a recession, consensus remains split with many placing the odds at roughly 50% - a view we currently share.

Source: Bloomberg

Muni Bond Market

Recent weeks have brought heightened volatility to the Municipal Bond market, driven largely by widespread selling pressure and liquidations within major Muni funds. These market movements have created compelling entry points. We have been actively navigating this environment to better position client portfolios. As highlighted in the chart below, Tax-Equivalent yields (TEYs) exceeding 7% are now available for Arizona residents in the highest tax bracket.

Source: MMD, TFS

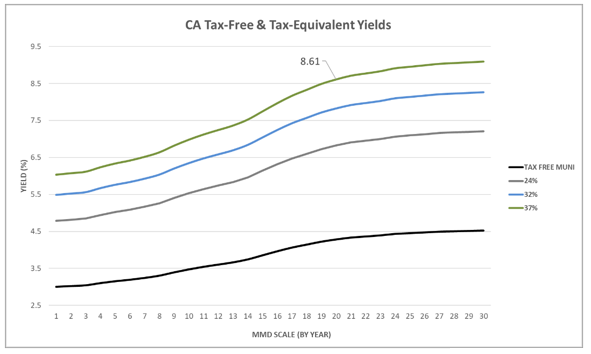

We continue to find the 20-year maturity range on the long end of the yield curve to offer the most compelling value. For California residents, the opportunity is even more pronounced, with Tax-Equivalent Yields (TEYs) exceeding 8.5% for those in the highest tax bracket, based on the MMD Scale below. Our strategy seeks to capture additional yield by purchasing bonds at spreads of 40-100 basis points over MMD, resulting in even more favorable TEYs across client portfolios.

Source: MMD, TFS

Munis vs Treasuries

The chart below highlights a significant development in the relationship between municipal bonds and U.S. Treasuries. The 20-Year Muni / 10-Year Treasury Ratio has surged in recent months, briefly exceeding parity—a level not seen since 2022.

For the past two years, municipal bonds traded at elevated prices relative to Treasuries, with ratios reflecting the typical premium investors are willing to pay for tax-exempt income. However, since the start of the year, this trend has reversed sharply.

Today, high-quality 20-year municipal bonds are yielding more than 10-year Treasuries on a nominal basis. When adjusted for taxes, particularly for investors in higher tax brackets, the Tax-Equivalent Yields (TEYs) become even more compelling.

Source: Bloomberg

Conclusion

While markets remain fixated on inflation and policy direction, we are also mindful of the growing pressures on the U.S. consumer. Rising debt levels and affordability challenges—particularly in housing and auto markets—suggest that consumer strength is beginning to erode. While uncertainty around policy, inflation, the consumer, and economic growth continue to weigh on markets, dislocations such as those seen in the Municipal Bond space present rare opportunities. Our focus remains on actively managing portfolios to capture value when and where it emerges. We believe our disciplined, long-term strategies will continue to serve clients well, even amidst short-term volatility.