Taxable bonds outperformed tax‐free Munis to begin the year as Munis struggled with increased new issue supply.

Return Review

Shorter municipals lagged the pack slightly as the tax‐free yield curve continued to flatten. The table below shows the first quarter returns for a variety of Merrill Lynch Bond Indices.

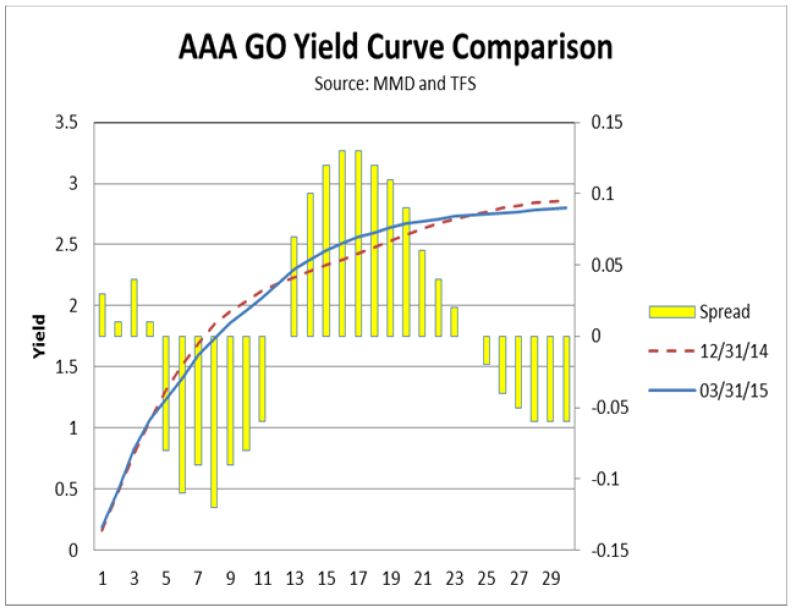

Changes In The Yield Curve For Munis Year To Date

The graph below shows the yield curve shift for Munis since the beginning of the year. The curve did not change significantly during the first quarter. The yellow bars show the change in yields for each maturity on the curve, with the yellow bars above zero indicating increases in yield and those below indicating decreases. Yields have risen slightly in the 13‐20 year area and have fallen slightly in the 5‐10 year part of the curve and in the long end of the market. This is a very unusual yield curve shift since the yield curve normally shifts in a parallel manner. We are expecting the curve to remain relatively flat or possibly flatten even more during the rest of 2015.

The Economy: Average Hourly Earnings (AHE) and Inflation

Average Hourly Earnings is a good indicator to follow when examining inflationary pressures in the economy caused by wage increases. Our studies show the correlation between changes in this indicator and Core CPI is 0.78 for the period beginning 1/1/1965. This is a significant degree of correlation and is illustrated in the chart below. The average annual increase in AHE since 1965 is 4.3%. Wages are currently increasing at only 1.6% annually, and have only increased 2.7% on average during the last 10 years. This indicates an absence of wage pressures in our economy. This is one of the reasons inflation has been below the Feds 2% target. It will be difficult for interest rates to rise if inflation continues to surprise to the downside. We will continue to monitor this indicator for possible signs of wage pressure in the future.

Ben Bernanke’s New Blog

The former chairman of the Fed has recently created a blog on the Brookings Institute site. One of his first posts was “Why are interest rates so low?” In this post he made some insightful comments which he was not able to do when he was Fed chair. For example, “the Fed’s ability to affect real rates of return, especially longer‐term rates is transitory and limited. Except in the short run, real interest rates are determined by a wide range of economic factors, including prospects for economic growth‐not by the Fed.” He also talked about the fear of raising rates prematurely: “The slowing economy in turn would have forced the Fed to capitulate and reduce market interest rates again. This is hardly a hypothetical scenario: In recent years, several major central banks have prematurely raised interest rates, only to be forced by a worsening economy to backpedal and retract the increases.” In short, the Fed’s actions are largely data dependent. This makes them a follower of market movements, not the cause of market movements. Investors would be wise to keep this in mind when worrying about the Fed raising interest rates later this year. Rate increases will not occur in a vacuum and will be a reaction to market developments. Recently economic indicators have been showing some indication of weakness rather than strength in the economy. If this continues any increase in rates will be transitory.

Muni Bond Market Credit Analyst Survey Results

Janney did a survey of 162 Muni credit analysts and 86% of these credit analysts are most concerned about the funding levels of public pensions. Some of the other top issues/trends were Puerto Rico, Infrastructure, Chapter 9 municipal bankruptcy proliferation, and disclosure. Most analysts felt State and Local government credit quality has recovered from the great recession caused by the financial crisis 6 years ago. Most of the analysts surveyed felt that Moody’s and Fitch did a better job of rating Munis than S&P. This survey did a good job of identifying the top issues for Munis today.

Pension and Other Post Employment Benefit (OPEB) Liabilities

We are particularly concerned about identifying and avoiding credits with large unfunded liabilities. Most municipalities have fiscal years ending June 30th. Beginning this year the Governmental Accounting Standards Board (GASB) is requiring municipalities to disclose all unfunded liabilities in their financial statements. This will make it much easier to identify State and Local governments that have not been adequately funding their pension and OPEB liabilities. We are already beginning to see improvements in the disclosure of these liabilities. For example, the City of Hamden, CT recently brought a new pension issue to market. Hamden has a population of about 60,000. They have been delinquent in making their pension contributions for the last several years. They now have an unfunded pension liability of about $450 million and a similar unfunded OPEB liability. This equates to an onerous $15,000 per man, woman, and child in Hamden. Obviously, these bonds did not meet our standards. The City of Chicago has an unfunded pension liability of about 70%. Puerto Rico has huge unfunded liabilities. We seek to avoid these types of credits. We are much more comfortable with bonds for local school districts instead of general obligation bonds for large cities with unfunded liabilities.

Infrastructure Needs

Since the financial crisis many States and Cities have redirected funds dedicated for infrastructure needs to balancing their budgets. This is a short term solution to a long term problem. Streets and highways, bridges, and other similar public assets are falling into disrepair. Taxpayers will expect to have improvements made in these areas. Unfortunately, they have also demonstrated an unwillingness to pay for these projects. We will be watching closely to see how these projects get funded. One possibility would be for them to be funded by Public Private Partnerships (P‐3’s). A correctional facility run by a private firm would be an example of a Public Private Partnership. In this type of arrangement the State enters into an agreement with the firm providing inmate services instead of providing these services themselves. This transfers the risk of funding the correctional facilities and services to the private sector. This adds a healthy dose of discipline to defining the services needed and reducing the costs of the project.

They will have to be creative in finding ways to provide the services taxpayers demand with the revenues taxpayers are willing to pay for these services. We will continue to monitor shifts in the yield curve and inflation indicators such as average hourly earnings as we move forward in this low interest rate environment.