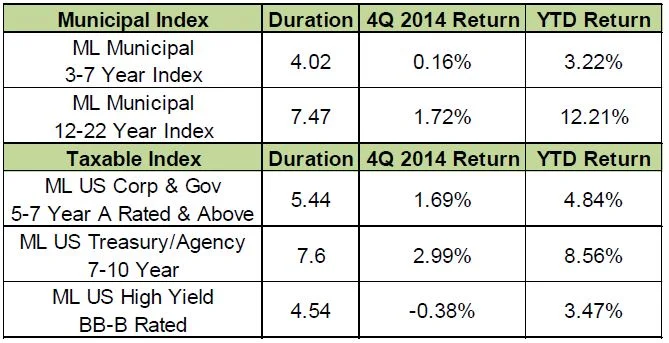

Long municipal bonds had the best performance of 2014, while municipal bonds in the 3‐7 year range and high yield paper performed the worst.

Return Summary

The following table summarizes the fourth quarter returns for some of the major Merrill Lynch Bond Indices.

Growth Rate of the economy

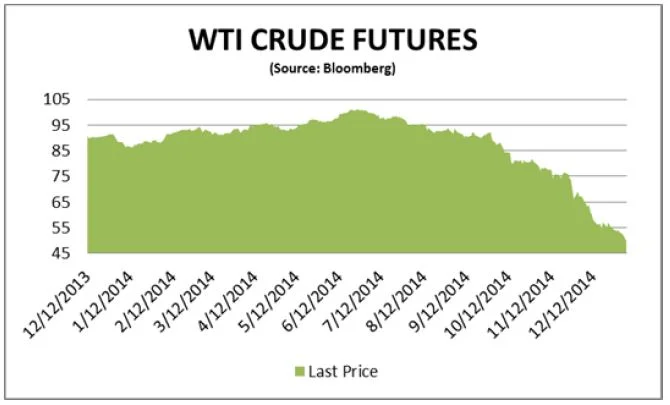

The U.S. economy has shown some recent signs of improvement, including a revised third quarter GDP growth rate of 5.0% (quarter over quarter), the highest in over ten years. While arguments can be made about the source and sustainability of this growth, we believe the sizeable declines in the price of oil over the past few months will further stimulate the economy. The U.S. consumer accounts for roughly 70% of economic growth, and lower gas prices mean more discretionary income to fuel that growth. The ultimate size of this impact will depend on how low oil prices get, and how long they stay there. The chart below shows the decline in the price of oil from over $100 per barrel in June 2014 to below $50 in the New Year.

Economic Growth and the Dollar

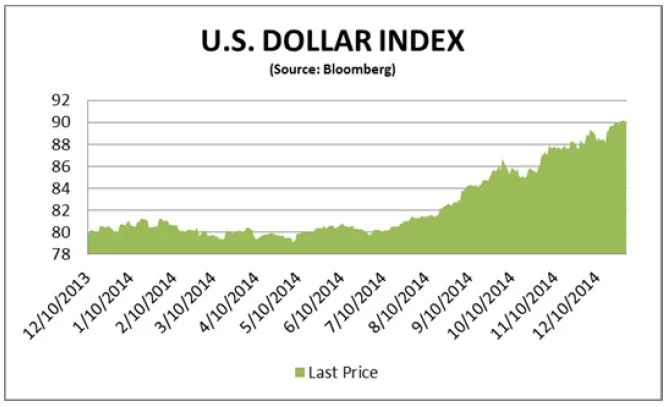

The dollar has appreciated over 14% percent since July of 2014. This increase can be attributed to a stronger U.S. economy, a flight from geo‐political risk, and higher U.S. interest rates (compared to global rates). While often the sign of a strengthening economy, this appreciation will also make our exports more expensive and hinder our ability to sell goods overseas. The potential for slower exports, coupled with negative demographic trends and high global debt levels should dampen the positive impact of lower oil prices domestically. The chart below shows the U.S. dollar index over the past year.

Inflation Expectations

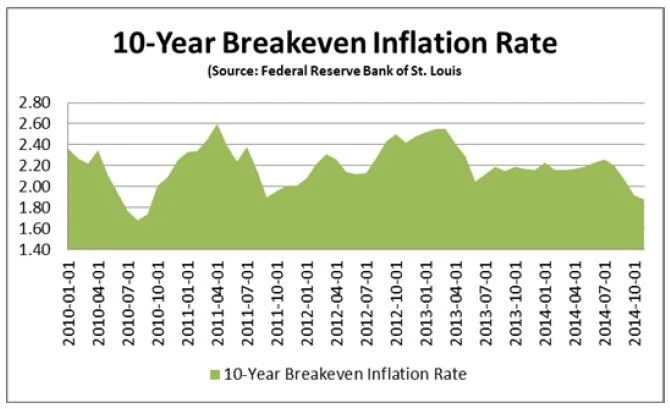

Inflation expectations appear to be well anchored, as illustrated by the 10 year breakeven inflation rate. This rate, the difference between the 10 year treasury yield and 10 year TIPS yield, suggests that the bond market expects inflation to average just 1.65% over the next 10 years. This is down from 2.6% in 2013 and well below the Feds 2% inflation target. Deflation can force central banks into ever increasing accommodative policies, including keeping interest rates lower for longer. The chart on the following page shows the 10 year breakeven rate going back to 2010.

Lessons Learned About Distressed Debt

During the financial crisis we learned a very valuable lesson from studying the bankruptcies of GM and Chrysler. Both of these firms were in severe distress due to over indebtedness and bloated employee pension and other union benefit costs. The government reorganized these firms by taking what were (according to bankruptcy law) junior employee claims and making them senior to bondholders. The lesson here is this: in a distressed financial situation the law is not as important as the political circumstances regarding employees, and bondholders cannot rely on what were previously considered solid legal protections. This lesson, first learned on the corporate credit side, also clearly translates to municipal bonds. In the case of Detroit, for instance, the bankruptcy judge transformed the senior claims of General Obligation bondholders, backed by the taxing power of the City of Detroit, and made them junior to the previously subordinated claims of the unions. The public rallied to protect paintings in the museum from being sold, and State politicians came up with funds so the unions were unimpaired. After announcing his decision, the judge said his “conscience” told him he was doing the right thing.

The Credit Selection Process Today

One of the great things about the Muni market is that there are roughly 50,000 different issues to choose from. We recommend a strategy of investing in bonds that don’t have undue exposure to unfunded pension liabilities and OPEB (other post‐employment benefits such as healthcare.) The best way to do this is to avoid GO’s of large cities which have powerful public unions. For example, we would avoid City of Chicago bonds which have an unfunded pension liability of about 70%. We would also avoid the State of Illinois bonds since they have been unwilling to do what it takes to manage their finances.

We view Puerto Rico bonds as speculative securities. The island is experiencing declines in population, extreme over indebtedness, and massive levels of unfunded liabilities. When a restructuring comes existing bondholders will be told by both the government of Puerto Rico and a judge they should have “known better” and were obviously well aware of the risks they were taking when making these risky investments.

Additionally, we don’t like bonds secured by revenues from settlements with the tobacco companies. These bonds are extremely risky since the amounts of monies available for debt service are in a severe decline.

We would rather buy bonds for local school districts, essential service revenue bonds, and bonds that have a dedicated revenue stream we can follow. For example, we would rather buy bonds for a good hospital than a GO for a large city. These credits are more easily monitored and less likely to have strong opposition from public unions.

As always, security selection has never been more important. We believe there are plenty of opportunities to invest in the right kinds of credits in the Muni market so that pitfalls may be avoided.