The federal funds rate stands at 1.75 (upper bound) after two hikes from the FOMC in the first quarter. Longer dated fixed income securities underperformed as higher rates were absorbed by the market.

Review

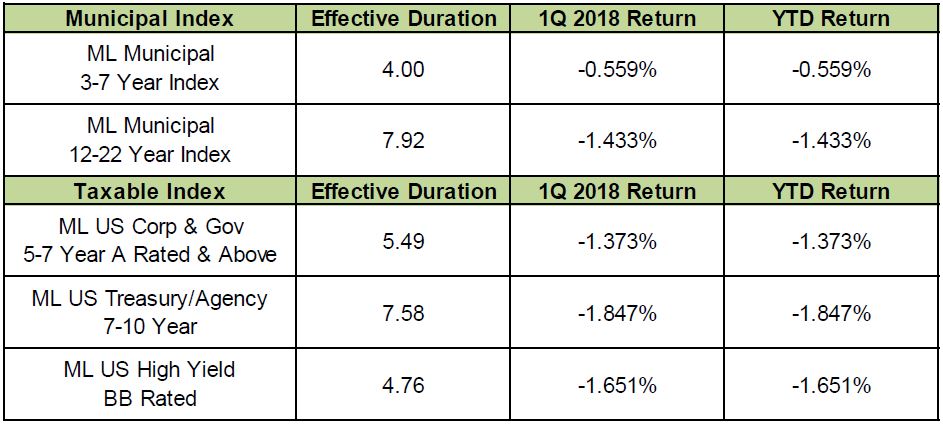

The following table summarizes returns for some major Merrill Lynch Bond Indices.

Trade and Tariffs

The fear of catastrophic trade wars, which would send the economy into a tailspin, has recently helped to increase volatility in the equity markets. President Trump has exacerbated these fears with tweets and comments about how unfair our current trade agreements are for the U.S., and how he is going to put tariffs on imported goods to level the playing field for U.S. firms and workers. This discussion about tariffs and possible trade wars makes most economists very nervous. Almost all economists agree free trade is a good thing and everyone benefits from free trade. Economic textbooks teach this as a basic principle of economics.

We would like to point out some important points regarding free trade. First, not everyone benefits from free trade. The worker that loses his job because his company can get it done cheaper overseas does not benefit from free trade. Instead he/she is a victim of free trade. Consumers who can buy imported goods more cheaply than those made domestically are the primary beneficiaries of cheap foreign goods. Next, countries that run a trade surplus benefit by the extra dollars they receive. These countries can then invest these dollars in U.S. securities such as stocks and bonds, in real estate, or the purchasing of American companies. This represents a transfer of wealth from America to other countries. Proponents of free trade make the argument that over time equilibrium will be reached so the trade between countries balances out. This has not been the case for the U.S.

The table on the following page shows the trade deficit the U.S. ran with its global trading partners last year. The U.S. ran a trade deficit of $568 billion in 2017. Our trade deficit with China alone was $337 billion. While the equity markets have been gyrating, the bond markets have not moved much. We view this as an indication that either we won’t get into major trade wars with our trading partners, or the effects won’t be negative enough to slow economic growth meaningfully. We currently view most of the talk about trade wars as noise for the bond market. However, we will be monitoring developments for signs that global economic growth will be impacted by renegotiating trade agreements which affect the U.S.

Globalization vs Populism

Populism has been increasing globally. This has led to Brexit in Britain and President Trump getting elected in the U.S. One of the benefits of globalization has been the ability for consumers to purchase cheaper imported goods. This has contributed to a long period of disinflation globally in the developed countries. It would seem possible that the trend of disinflation caused by globalization might be coming to an end.

MSRB Transparency Rule

A research paper regarding “Secondary Trading Costs in the Municipal Bond Market” by Lawrence Harris and Michael S. Piwowar was first published May 16, 2006. This paper discussed the high transaction costs for retail accounts for Muni bonds which averaged more than 2.0% per transaction. For example, the purchase of a $50,000 block of bonds would have markups of about $1,000. The paper concluded that these costs were significantly higher than similar-sized equity trades which might be less than $25.00. Since this paper was published Mr. Piwowar had become the acting head of the SEC for the first part of last year until Jay Clayton took over. It should be no surprise that Mr. Piwowar supports lower transaction costs for purchases of Muni bonds by retail investors and has had significant influence in this regard at the SEC.

In response to pressure from the SEC, the Municipal Securities Rulemaking Board (MSRB) has initiated a new rule (G-15) which is on track to go into effect in May 2018. This rule is called the “markup disclosure rule” and is designed to make retail transactions in the Muni market more transparent. This rule requires brokerage firms to disclose the mark-up or mark-down on purchases/sales of corporate, agency and municipal bonds by retail investors. These markups above the prevailing market price of the bonds will be shown on confirms received by investors. The transparency caused by this rule will make it less attractive for brokers whose practices depend on large commissions for bond trades and will make fee-based models using Separate Account Managers more attractive for them going forward.

Yield Curve Flattening

The chart below shows the spread between the 5 and 10-year UST compared to the Fed Funds Rate. This spread is one measure of how the yield curve has flattened since the Funds rate hit the zero bound and began to rise. We expect this trend to continue until the Fed has finished tightening. Unfortunately, the Fed has a history of tightening until something breaks. There is no reason to believe this time will be different.

Our barbell strategy continues to work well as the yield curve continues to flatten. We expect this trend to continue until the Fed is done raising rates.